© alice-photo 2022

WHAT IS PRIVATE EQUITY?

Private equity began as a way to finance private companies (hence “private” equity) and now also invests in and takes over public companies. It is an industry as secretive about its business dealings as its billionaire CEOs are extravagant with multiple mansions, private jets, and yachts docked around the globe.

How It Works

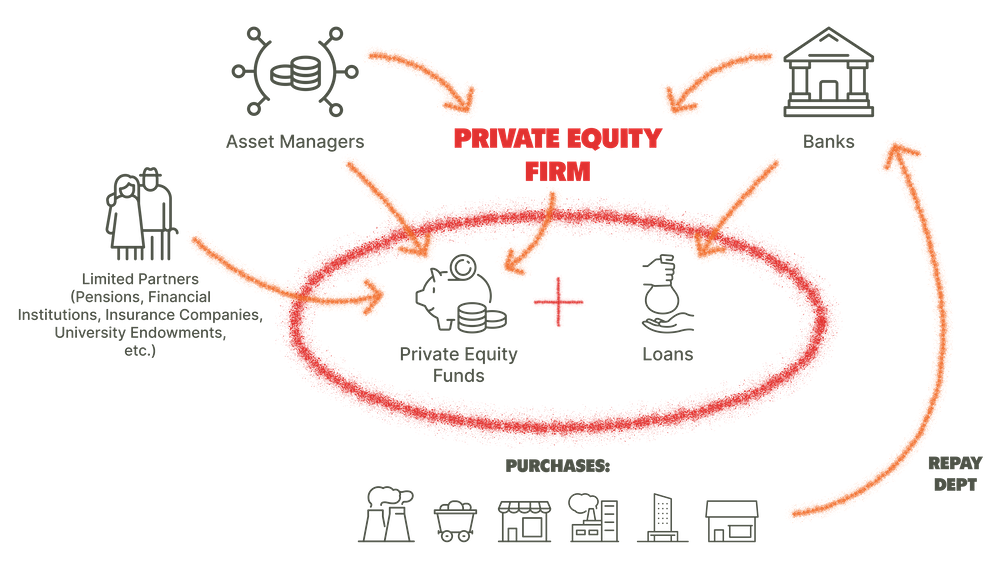

Private equity firms raise large sums of money from pension funds, school endowments, foundations, government-owned funds, and insurance companies with the promise of delivering strong returns. The firms use those large pools of capital to buy private companies or struggling public companies under a business model called a Leveraged Buyout (LBO).

In an LBO, the private equity firms purchase a company using, on average, 10 percent cash and 90 percent debt. The company is then responsible for paying back the debt.

THE IMPACT

The LBO business model can result in:

- Lay offs and compromised worker safety

- Losses to pension funds

- Cut severance packages

- Cuts to retiree packages

- Bankruptcy

- Reduction of tax revenue

While private equity executives walk away with millions of dollars, working people and local economies are left suffering. In the last decade, private equity takeovers led to some of the largest retailer bankruptcies in the nation, including Toys R Us, Radio Shack, and Payless ShoeSource.

© saravutpics 2022

HIDING IN PLAIN SIGHT

In addition to retail, private equity firms are buying houses and apartments, nursing homes, hospitals, newspapers, and fossil-fuel assets using the same problematic business model.